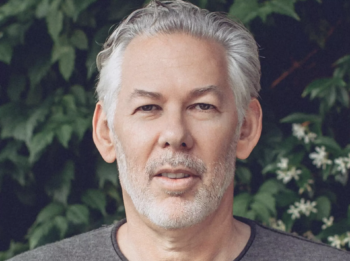

Throw a stone, and you’re bound to hit a news article about Netflix these days. Seemingly on top of the world only two months ago, Netflix is now under fire for a recent price hike, a failed negotiation with one of their largest content providers, and a rash decision to spin-off their DVD-by-mail business (I’ll spare you my personal commentary on the re-branding). The last of which has CEO Reed Hastings personally responding to over 26,000 negative comments on the company’s official blog and has brought their stock price to its lowest in over a year.

Arguably, Netflix’s “Watch Instantly” streaming service is now the core of the 12-year-old company’s movie rental business, and with good reason. Anyone under the age of 65 can tell you that streaming is the future of video consumption, and Netflix has done a fantastic job of enabling that service for close to 25 million subscribers. With an enormous back catalog of movies and TV shows, a clean and simple-to-navigate user interface, and access on over 450 different devices, Netflix is the epitome of premium, streaming video. Add to that a fair, all-you-can-eat price of only $7.98 a month, and you can easily see why the service has quickly surpassed the reach of the US’s largest cable provider. Unfortunately, both the public and the company’s investors are beginning to see why Netflix’s economical price might just be too good to be true.

At the top of Netflix’s list of pricing challenges is their ability to meet the increasing cost that content providers are now requiring for streaming licenses. It’s rumored that the recent asking price for streaming rights from Starz was $300 million. That’s ten times what Netflix had paid the network just three years ago. Next on that list is a growing number of competitors who are already striking deals to build out their own streaming service that would directly rival Netflix’s offering. These companies include Apple, Walmart (Vudu), Amazon… and that’s just to name a few.

Surprisingly, the “sleeping giant” of threats Netflix will have to face in the coming years is from an industry whose inability to innovate quickly has actually lead to the growth of Netflix’s service. Pay-TV providers have taken almost a decade to realize the huge opportunity that video-on-demand (VOD) presents, and Netflix’s success has taught them a valuable lesson. Netflix’s lead in this realm will not last, however, as the likes of Time Warner and Comcast are already spending massive amounts of time and resources to build out an extensive content library, an overhaul of their VOD interface, and the ability to watch content on-the-go, called “TV Everywhere.”

So what is Netflix to do? How can they continue to provide an economically priced service that’s rich in content and innovative beyond its competition? Well, if you’ve read some of my earlier Tech.Li posts, you may know where I’m headed with this… Netflix should embrace advertising.

Now I know what you’re saying, you can’t just stick ads into Netflix’s streaming service without alienating users and essentially turning Netflix into an online-based, cable TV provider. However, by creatively (i.e. beyond the standard :30 ad) incorporating advertisers into their streaming service, Netflix could keep their prices low and continue to innovate ahead of their competitors. More importantly, Netflix would gain a second revenue stream, as well as the clout of big-name advertisers that could help the company strike future content deals. Advertisers themselves would have access to a new marketing platform with over 25MM users. Everyone stands to benefit.

It’s a little known fact that in the early days of Netflix, banner ads helped to keep the lights on. There’s a huge opportunity here and Netflix needs to make a move soon, otherwise many of us will have to go back to paying for a costly cable subscription.

PS – Mr. Hastings, if you happen to come across this post, I have some killer ideas on how ads can be incorporated without ruining Netflix’s consumer value proposition. Feel free to drop me a note :).